INVESTING

25 Things Millionaires Never Waste Money On

Published

6 months agoon

Shutterstock

Millionaires are often seen as extravagant spenders, but in reality, they are incredibly strategic about how they use their money. They understand the importance of mindful spending and avoid wasting their wealth on things that don’t provide long-term value. Focusing on investments and purchases that contribute to their financial goals ensures that every dollar spent works for them, not against them. From avoiding impulse buys to steering clear of trendy real estate, their habits reveal a disciplined approach to money management. In this article, we’ll explore 25 things that millionaires never waste their money on and how these choices contribute to their enduring financial success.

Impulse Purchases

Shutterstock

Millionaires understand the value of thoughtful spending and rarely make purchases on a whim. They carefully consider whether an item aligns with their long-term financial goals before pulling out their wallet. By avoiding impulse purchases, they save money that can be better invested elsewhere. This disciplined approach helps them maintain and grow their wealth over time.

Luxury Cars (as Status Symbols)

Shutterstock

While some millionaires do own luxury vehicles, they don’t buy them just to show off. They tend to choose cars that offer reliability, safety, and good value rather than focusing solely on brand prestige. For many, a car is a tool to get from point A to point B, not a status symbol. This practical mindset allows them to allocate their resources to investments that yield better returns.

Trendy Fashion

Shutterstock

Instead of chasing fleeting fashion trends, millionaires invest in high-quality, timeless pieces that stand the test of time. They know that classic styles not only look sophisticated but also save money in the long run because they don’t need to be replaced as frequently. This approach to fashion reflects their broader financial philosophy of making smart, enduring investments. By avoiding trendy purchases, they maintain a wardrobe that is both stylish and economical.

Lottery Tickets

Shutterstock

The odds of winning the lottery are staggeringly low, and millionaires know that spending money on lottery tickets is not a wise financial strategy. They prefer to invest their money in ventures with predictable returns rather than gambling on a near-impossible outcome. This disciplined approach to risk is a key factor in their financial success. By avoiding the lottery, they keep their money working for them in more productive ways.

Overpriced Coffee

Shutterstock

Many millionaires opt to make their coffee at home instead of spending several dollars a day at a coffee shop. They understand that these small daily savings can add up to a significant amount over time. By making this simple adjustment, they redirect their funds towards more meaningful investments. This habit reflects their broader philosophy of mindful spending.

Dining Out Frequently

Shutterstock

While millionaires may enjoy a nice meal out occasionally, they typically avoid making dining out a regular habit. They recognize that cooking at home not only saves money but also allows for healthier eating. By limiting their restaurant visits, they keep more of their money in their pockets. This approach is part of a larger strategy of reducing unnecessary expenses.

Extended Warranties

Shutterstock

Millionaires often skip purchasing extended warranties on products because they understand that these are usually not cost-effective. They know that the majority of products don’t fail within the warranty period, making this an unnecessary expense. Instead, they might set aside a small emergency fund for unexpected repairs or replacements. This strategy allows them to save money by avoiding extra costs that rarely pay off.

High-End Gadgets

Shutterstock

Millionaires don’t feel the need to always have the latest technology just because it’s new or trendy. They carefully evaluate the utility of new gadgets and only upgrade when there’s a clear, practical benefit. By avoiding the constant need to own the latest tech, they save money that can be better invested elsewhere. This mindful approach to technology helps them avoid unnecessary expenditures.

Luxury Brand Name Products

Shutterstock

Millionaires tend to focus on the quality and utility of a product rather than its brand name. They often avoid paying a premium just for a luxury label when they can get the same or better quality for less. This approach allows them to allocate their resources more efficiently. By being selective about brand names, they ensure their spending aligns with their financial goals.

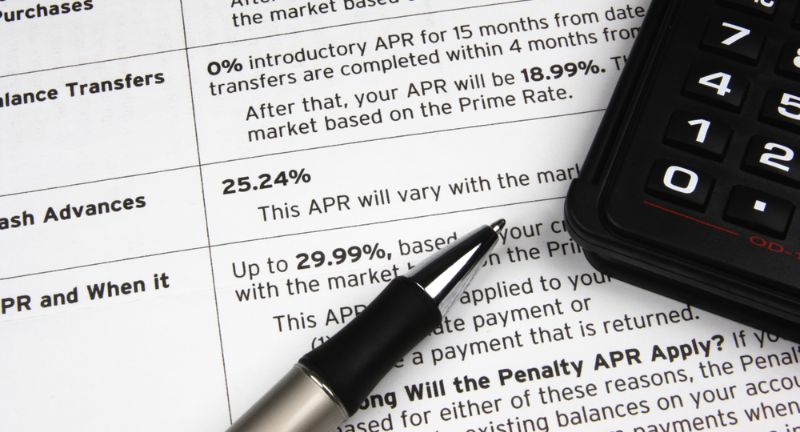

Credit Card Interest

Shutterstock

Millionaires make it a priority to pay off their credit card balances in full each month to avoid high interest charges. They understand that credit card interest can quickly erode wealth if not managed carefully. By staying debt-free or minimizing debt, they keep their finances healthy and avoid unnecessary costs. This disciplined approach helps them maintain and grow their wealth.

Excessive Home Decor

Shutterstock

Millionaires are more likely to invest in quality, meaningful decor rather than constantly changing their home’s look to keep up with trends. They understand that excessive spending on home decor can be a wasteful use of resources. Instead, they opt for classic and durable pieces that add value to their living space. This thoughtful approach to home decor reflects their broader financial principles.

Expensive Alcohol

Shutterstock

While millionaires may enjoy a good bottle of wine or spirits, they typically avoid spending excessively on alcohol, especially when it’s just to impress others. They know that expensive drinks can quickly add up and don’t provide lasting value. By being selective with their alcohol purchases, they save money and avoid unnecessary extravagance. This mindful spending habit contributes to their overall financial health.

Unused Subscriptions

Shutterstock

Millionaires regularly review their subscriptions to ensure they’re only paying for services they actually use. They are quick to cancel any subscriptions that no longer provide value. This practice prevents money from being wasted on unnecessary or forgotten services. By staying on top of their subscriptions, they keep their spending efficient and focused on what truly matters.

Gambling

Shutterstock

Millionaires generally avoid gambling because they understand that the odds are stacked against them. Instead of risking their money on chance, they prefer to invest in opportunities with more predictable returns. Gambling is seen as an unnecessary risk that can quickly erode wealth. By steering clear of gambling, they protect their assets and focus on more reliable ways to grow their money.

Expensive Gifts

Shutterstock

When it comes to gift-giving, millionaires often prioritize thoughtfulness over price. They understand that the value of a gift lies in its sentiment rather than its cost. By choosing meaningful gifts instead of expensive ones, they create more memorable and appreciated experiences. This approach also helps them avoid unnecessary spending while still expressing generosity.

Fancy Cars with Short Leases

Shutterstock

Leasing a luxury car for a short period can be a costly decision, and millionaires are usually aware of this. They prefer to buy cars that retain their value over time instead of opting for leases that result in perpetual payments. This strategy allows them to avoid the financial drain of continuous leasing and depreciation. By purchasing rather than leasing, they make more cost-effective vehicle decisions.

Frequent Vacations

Shutterstock

While millionaires may enjoy travel, they typically plan their vacations carefully and avoid impulsive, expensive getaways. They understand that frequent vacations can disrupt their financial plans if not managed properly. By limiting their trips, they ensure that their travel spending aligns with their broader financial goals. This disciplined approach to vacationing helps them maintain a balanced lifestyle without compromising their wealth.

Trendy Real Estate

Shutterstock

Millionaires avoid buying real estate in trendy, overpriced markets because they understand that such investments often come with inflated risks. Instead, they focus on properties with long-term potential for appreciation and stable returns. This careful selection process ensures that their real estate investments contribute positively to their overall wealth. By staying clear of trendy markets, they avoid the pitfalls of speculative investing.

Unnecessary Insurance

Shutterstock

Millionaires are savvy about the types of insurance they carry, opting only for policies that offer significant protection. They avoid paying for insurance that they don’t need or that provides minimal benefit. By carefully assessing their insurance needs, they avoid wasting money on unnecessary coverage. This approach helps them maximize their financial efficiency and avoid unnecessary costs.

Bank Fees

Shutterstock

Millionaires are diligent about avoiding unnecessary bank fees by choosing accounts that offer free services or by maintaining the minimum balance required to avoid fees. They understand that small fees can add up over time and prefer to keep that money in their own pockets. By managing their accounts wisely, they ensure that they’re not paying for services they don’t need. This careful approach to banking is part of their broader strategy of minimizing unnecessary expenses.

Multiple Credit Cards

Shutterstock

While millionaires might use credit cards for convenience, they avoid having numerous cards, which can lead to overspending and unnecessary fees. They prefer to manage a few cards carefully, paying off balances in full each month to avoid interest. By keeping their credit card usage simple and controlled, they maintain better control over their finances. This disciplined approach helps them avoid the pitfalls of excessive credit.

Expensive Weddings

Shutterstock

Millionaires often opt for more modest weddings that focus on the significance of the day rather than on extravagant displays of wealth. They understand that a wedding is just one day and prefer to invest in their future together rather than spending excessively on the event. By keeping their weddings simple, they avoid unnecessary costs and stress. This approach reflects their broader values of thoughtful spending and long-term planning.

Luxury Gym Memberships

Shutterstock

Millionaires might invest in their health, but they avoid paying for expensive gym memberships that they don’t use. They prefer fitness options that offer good value and that fit into their lifestyle. By choosing wisely, they ensure they’re not wasting money on memberships they won’t utilize. This practical approach to fitness spending helps them stay healthy without overspending.

Designer Pet Accessories

Shutterstock

While millionaires care deeply for their pets, they often avoid splurging on unnecessary luxury pet products. They focus on their pets’ health and happiness rather than on expensive accessories that add little value. By choosing functional and practical pet supplies, they save money without compromising on their pets’ well-being. This approach ensures their spending is aligned with their values of practicality and efficiency.

Time-Wasting Entertainment

Shutterstock

Millionaires value their time and avoid spending money on entertainment that doesn’t provide value or contribute to their personal growth or relaxation. They prefer activities that enrich their lives and help them achieve their goals. By being selective about how they spend their leisure time, they ensure that every dollar spent on entertainment has a purpose. This intentional approach to entertainment spending helps them maintain a balanced and fulfilling lifestyle.

Conclusion

Shutterstock

Adopting some of the spending habits of millionaires can be a valuable step toward financial security and success. By being mindful of where your money goes and focusing on purchases that offer long-term value, you can make your money work harder for you. Millionaires didn’t achieve their wealth by chance; they cultivated habits that support their financial goals. Implementing these practices in your own life can help you build and preserve your wealth over time. Remember, true financial success lies not just in how much you earn, but in how wisely you manage your resources.

ADVERTISEMENT - CONTINUE BELOW

Related Topics:

About Money+Investing

Money + Investing provides our community with the latest personal and business finance news from around the world. We publish money saving and earning tips to help you make smartier investing decisions. We're inspired by exploring and providing new ways for our audience to achieve financial freedom. We can't wait to share all of our exciting deals, guides and reviews to help you live your financial life to the fullest.