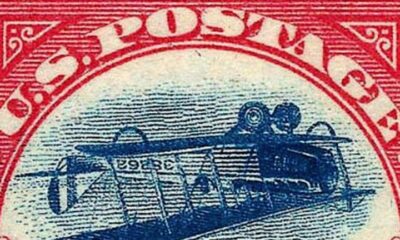

Courtesy of @mortgageus via Instagram

Mortgage rates dropped slightly last week after surging for several weeks in a row, but mortgage demand continued to fall, reaching a 27-year low according to the latest report from the Mortgage Bankers Association.

The volume of mortgage applications in the week ending Sept. 1 declined 2.9% from the week before on a seasonally adjusted basis, according to the MBA’s Weekly Mortgage Applications Survey.

“Mortgage applications declined to the lowest level since December 1996, despite a drop in mortgage rates,” Joel Kan, MBA’s Vice President and Deputy Chief Economist, said in a statement.

“Both purchase and refinance applications fell, with the purchase index hitting a 28-year low, as prospective buyers remain on the sidelines due to low housing inventory and elevated mortgage rates,” Kan said.

The average interest rate for 30-year fixed-rate mortgages with conforming loan balances of $726,200 or less decreased last week to 7.21% from 7.31% the week before. The average rate for 30-year fixed-rate mortgages for so-called jumbo loans with higher balances fell to 7.21% from 7.28%.

Despite the drop, “rates remained more than a full percentage point higher than a year ago, despite mixed data on the health of the economy and signs of a cooling job market,” Kan said.

“Consumers are in a real estate logjam right now which is why mortgage applications are down,” said Ted Jenkin, founder and CEO of Atlanta-based oXYGen Financial. “They would like to upgrade their homes, but can’t make the math work when they have 30-year, 3% mortgages on their current homes.”

TMX contributed to this article.