Courtesy of federalstudentaid/Instagram

Interest accrual on student loans is set to resume Sept. 1, and borrowers will have to begin making payments in October, after being paused for more than three years.

Monthly student loan payments and the accumulation of interest were paused in early 2020 due to the Covid-19 pandemic.

Borrowers should evaluate their monthly expenses, and see which ones can be eliminated immediately, according to Lawrence Sprung, certified financial planner and author of “Financial Planning Made Personal.”

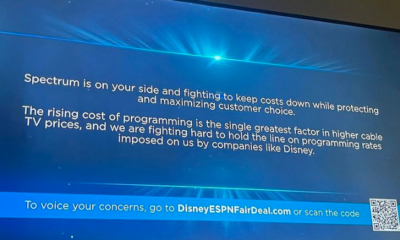

“There will certainly be some things that are no longer needed, wanted or used that you can get rid of at the first pass. In addition, if you have subscriptions or vendors that use and pay a monthly fee, such as cable, internet, or alarm, call them and see if you can negotiate a decrease in expense for being a loyal long-term customer,” Sprung said.

The resumption of loan payments could send shock waves through the economy, as households may be be forced to cut back on spending in other areas, Sprung said.

“The monies for these repayments will have to come from somewhere and I think the immediate reaction is this will affect retail spending. Time will tell if this is a reality, or if the effects end up being felt in another area of our economy,” Sprung said.

“This is an incredibly important time for families to sharpen their pencil and closely examine their family budgets. When you haven’t paid a bill for three years, it can easily become out of mind out of sight,” said Ted Jenkin, founder and CEO of Atlanta-based oXYGen Financial.

Both Sprung and Jenkin advise borrowers to look into the new income-based repayment SAVE plan launched by the Biden Administration last week.

The administration previously approved more than $116 billion in student debt cancellation for 3.4 million eligible borrowers, and the new SAVE, or Saving on a Valuable Education, plan targets an estimated 20 million borrowers who were not eligible.

Under the SAVE plan, payments are calculated based on income and family size, which will allow approved borrowers to reduce their monthly payments on undergraduate loans from 10% of disposable income to 5%.

For individual borrowers with an annual income less than about $32,000, monthly payments will be reduced to $0 until their income rises. For borrowers with a family of four, the annual income floor is about $67,000.

“As long as you pay what you owe under this plan, you’ll no longer see your loan balance grow because of unpaid interest,” President Joe Biden said in a statement announcing the plan.

To achieve this, The Department of Education will stop charging any monthly interest not covered by the borrower’s payment on the SAVE plan.

The administration said the average borrower will save about $1000 per year under the new repayment plan.

The new repayment plan marks a step toward appeasing overburdened student borrowers without an across-the-board cancellation of student debts.

“I wouldn’t count on student loan debt getting erased, and even if it did it doesn’t solve the real problem, which is the soaring costs of getting a college education. With no change, my view is that student loans will surpass $3 trillion in debt within 10 years,” Jenkin said.

TMX contributed to this article.