LIFE

20 Things You Should Never Leave in a Will

Published

3 months agoon

Shutterstock

Wills are essential documents for ensuring that your assets are distributed according to your wishes. However, there are certain things that you should avoid including in your will to prevent confusion, legal challenges, or delays in probate. From jointly owned property to digital passwords, some items are better handled through other legal channels. Being aware of these can help you craft a will that is clear, efficient, and legally sound. In this guide, we’ll explore 20 things that should never be left in your will.

Funeral Instructions

Shutterstock

Funeral instructions should not be included in your will because it’s often read after the funeral has already taken place. A better approach is to leave these instructions in a separate document or to communicate them directly to family members ahead of time. This ensures your wishes can be honored without delay or confusion. Including them in your will could create unnecessary stress and uncertainty during an already emotional time.

Jointly Owned Property

Shutterstock

When property is jointly owned with rights of survivorship, it automatically transfers to the co-owner when one owner dies. Including jointly owned property in your will can cause unnecessary legal complications. It might contradict the terms of the joint ownership, leading to confusion for your heirs. To avoid this, ensure the correct co-owner designation is in place, making it unnecessary to mention in the will.

Life Insurance Proceeds

Shutterstock

Life insurance proceeds are paid directly to the beneficiaries you name on the policy. Therefore, including life insurance in your will is not only redundant but could also delay the distribution of funds. The insurance company will distribute the proceeds based on the beneficiary designations, not the terms of your will. Ensure your beneficiary designations are up-to-date to avoid any conflicts.

Retirement Accounts

Shutterstock

Similar to life insurance, retirement accounts such as IRAs and 401(k)s have designated beneficiaries. The funds will go directly to those beneficiaries regardless of what’s written in your will. Including them in your will can create unnecessary confusion and even legal disputes. It’s important to keep your beneficiary designations current to reflect your true wishes.

Payable-on-Death Bank Accounts

Shutterstock

Bank accounts with payable-on-death (POD) designations pass directly to the named beneficiary upon your death. Including these accounts in your will is unnecessary and could complicate the legal process. The POD designation overrides anything stated in the will, making it irrelevant. Be sure that your bank has the correct POD information on file.

Illegal or Contraband Items

Shutterstock

Including illegal items, such as unregistered firearms or drugs, in your will is not just a bad idea—it’s unlawful. Passing on such items can put your heirs in legal trouble. It’s important to ensure that any items you intend to pass on are legal to own and transfer. Instead, properly dispose of any contraband or illegal property before it becomes a problem for your beneficiaries.

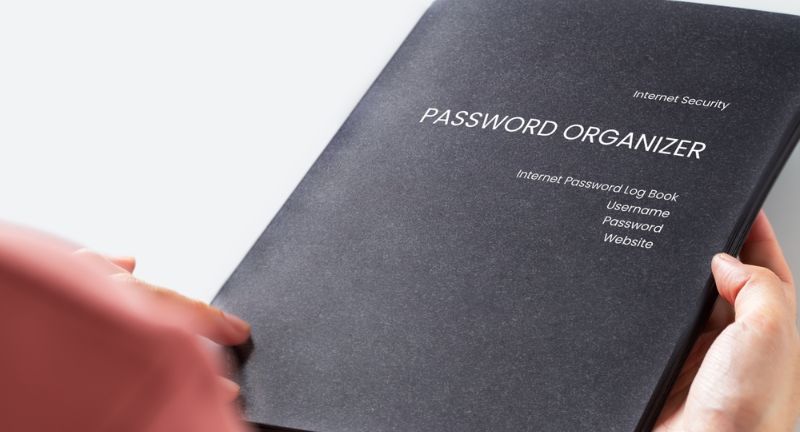

Digital Passwords

Shutterstock

Your will is not the place to leave digital passwords or login information. Wills become public documents during probate, making it risky to include sensitive data. Instead, keep a secure list of passwords in a password manager or another protected document, and share access with a trusted person. This will ensure your digital accounts can be accessed without compromising security.

Personal Wishes or Statements

Shutterstock

Wills are legal documents meant to distribute assets, not to express personal feelings or settle family disagreements. Including emotional statements or personal grievances can lead to misunderstandings or fuel conflicts among beneficiaries. If you wish to express personal thoughts, consider writing a separate letter to be delivered privately. This keeps your will focused on legal matters and avoids unnecessary drama.

Conditional Gifts Based on Personal Behavior

Shutterstock

Leaving gifts based on certain behaviors, such as requiring someone to marry or divorce, may not be enforceable. Courts often frown upon conditions that control someone’s personal life. These stipulations can also cause family tension and lead to legal battles. It’s best to avoid such clauses and focus on clear, unconditional bequests in your will.

Specific Medical Instructions

Shutterstock

Medical instructions, such as whether to remain on life support, should be outlined in a healthcare directive, not your will. Wills are often not reviewed until after a person’s death, making it impossible for these instructions to be followed in time. Create an advance healthcare directive or living will, which ensures your medical wishes are carried out promptly. This avoids confusion and ensures your healthcare preferences are respected.

Minors Without Guardianship Designations

Shutterstock

Leaving assets to minors without designating a guardian can create significant problems. A will should name both a guardian for the child and someone to manage the assets on their behalf. If no guardian is designated, the court may appoint one, which might not align with your wishes. Ensure that guardianship details are clearly outlined to prevent legal disputes or unwanted outcomes.

Long Explanations or Complex Directions

Shutterstock

Wills are best kept simple and straightforward. If you need to explain complex instructions or include lengthy details, consider using a trust or separate document. Long explanations can slow down probate and cause confusion for your executor and heirs. Make sure your will is clear and easy to understand to avoid unnecessary complications.

Pets Without a Plan for Care

Shutterstock

While you can leave money for a pet’s care, your will alone is not sufficient to ensure their wellbeing. Pets cannot inherit assets, so it’s better to establish a pet trust or designate a caretaker for them. Without a plan, your pets may not receive the care they need. Be proactive in making arrangements for your furry companions outside of your will.

Stocks, Bonds, or Other Securities

Shutterstock

If you’ve already set up a transfer-on-death (TOD) or pay-on-death (POD) designation for your stocks and bonds, there’s no need to include them in your will. These accounts bypass probate and automatically go to the designated beneficiary. Including them in your will can lead to unnecessary delays or confusion. Keep your financial designations up to date and separate from your will.

Assets Located in Foreign Countries

Shutterstock

If you own property or assets in another country, leaving them in your will may not be effective. Different countries have their own inheritance laws, and your will may not be valid there. To handle foreign assets properly, you should consult a legal expert who understands international estate planning. This ensures that these assets are handled according to local laws and your wishes.

Business Interests Without a Succession Plan

Shutterstock

Owning a business means more than just passing it down in a will. You should have a business succession plan in place to ensure a smooth transition. Leaving your business interests to heirs without a detailed plan can result in operational disruptions or disputes. Make sure the future of your business is well-secured through separate legal arrangements outside your will.

Property in a Living Trust

Shutterstock

If you’ve already placed property into a living trust, it will bypass probate and transfer directly to the beneficiaries. Including this property in your will is unnecessary and can lead to legal confusion. The living trust is designed to manage these assets efficiently without needing a will’s direction. Keep your living trust up-to-date to avoid any conflicts.

Debts You Want to Be Paid

Shutterstock

Your executor is responsible for settling your debts according to the law. Specifying certain debts to be paid in your will is unnecessary and could lead to confusion. The legal process for paying debts is already in place, and creditors will be dealt with accordingly. Focus your will on distributing assets, not on instructing debt payments.

Verbal Promises

Shutterstock

Verbal promises about your estate hold no legal weight in probate court. If you’ve promised something to someone, make sure it’s properly documented in your will or a legal agreement. Relying on verbal commitments can lead to disputes among heirs. For clarity and fairness, always put important matters in writing and follow the proper legal procedures.

Personal Property Without Clarity

Shutterstock

Personal property such as family heirlooms or sentimental items should be clearly designated in your will. Vague instructions or leaving items up to interpretation can cause disputes among heirs. It’s better to include a detailed personal property memorandum to ensure that each item goes to the intended recipient. This avoids potential arguments and keeps the distribution process smooth.

Conclusion

Shutterstock

By carefully considering what to leave out of your will, you can ensure that your estate is handled smoothly and according to your true wishes. Avoiding unnecessary or problematic items in your will can help prevent legal disputes, reduce stress for your loved ones, and streamline the probate process. Instead, focus on creating clear, concise instructions that are legally enforceable. Remember to consult with an estate planning expert to make sure all your assets are properly accounted for. With proper planning, you can leave a legacy that provides peace of mind for both you and your family.

ADVERTISEMENT - CONTINUE BELOW

Related Topics:

About Money+Investing

Money + Investing provides our community with the latest personal and business finance news from around the world. We publish money saving and earning tips to help you make smartier investing decisions. We're inspired by exploring and providing new ways for our audience to achieve financial freedom. We can't wait to share all of our exciting deals, guides and reviews to help you live your financial life to the fullest.

More Money + Investing

-

24 of the Fastest Ways to Build Passive Income

-

Low Stress Jobs That Pay Over $70,000

-

5 Top Remote Jobs For Baby Boomers

-

Social Security Adjustments Coming In 2024 – Here’s What You…

-

5 U.S. Cities Most Threatened By Climate Change

-

6 Tax Mistakes Made By The Middle Class Every Year

-

5 Things That Are No Longer Worth Buying

-

25 Ways to Simplify and Save During a No Spend…

-

25 Tips For Living Well on Social Security

-

20 Indulgent Purchases That Trap the Middle Class

-

7 Once Affordable Things That Are No Longer Worth It

-

7 Scams Targeting Older People And How To Protect Your…